[What are bid and ask prices in Forex trading?] Forex trading can be an exciting and profitable venture, but it’s crucial to understand key concepts like bid and ask prices in Forex trading. In this blog post, we’ll explore what bid and ask prices are and why they are essential in Forex trading. So, let’s dive in!

Understanding Bid Prices

When you enter the world of Forex trading, you’ll come across the term “bid price.” The bid price is the highest price that a buyer is willing to pay for a currency pair. Essentially, it represents the demand for a particular currency. For example, let’s say the bid price for the EUR/USD currency pair is 1.2300. This means that a buyer is willing to pay $1.23 for one euro.

What are the risks involved in Forex trading?

Understanding Ask Prices

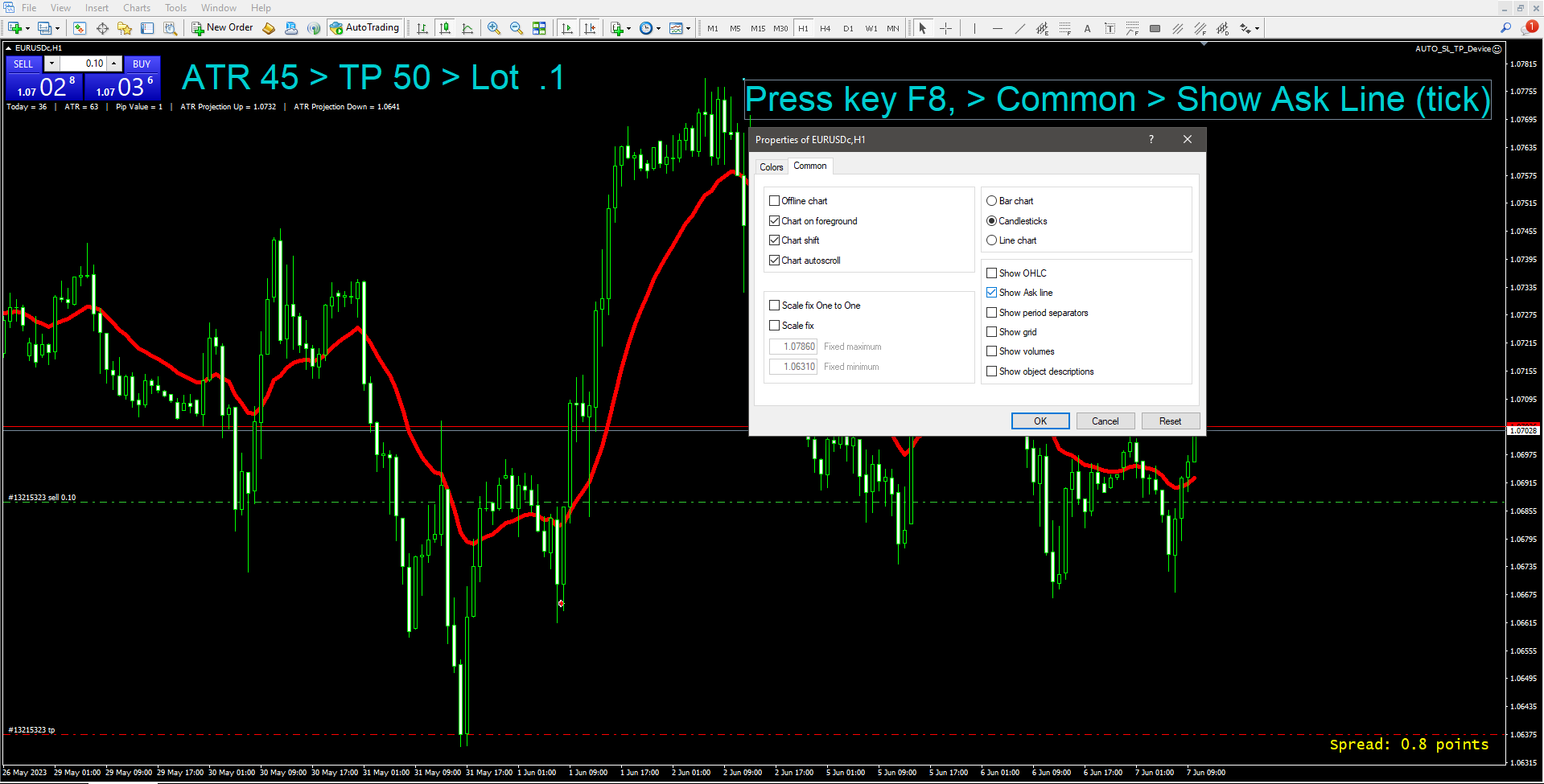

On the other side of the bid price, we have the “ask price.” The ask price is the lowest price that a seller is willing to accept for a currency pair. It reflects the supply of a particular currency. Continuing with our previous example, if the ask price for EUR/USD is 1.2305, it means that a seller is willing to sell one euro for $1.2305.

Bid-Ask Spread

The difference between the bid price and the ask price is known as the “bid-ask spread.” It’s the cost you pay to enter a trade. Let’s say the bid price is 1.2300 and the ask price is 1.2305 for the EUR/USD currency pair. The bid-ask spread here would be 0.0005 or “5 pips.” This spread represents the profit that brokers make.

Bid and Ask Prices in Forex Quotes

What skills and knowledge are required for successful Forex trading?

When you look at a Forex quote, you’ll notice two prices: the bid price and the ask price. Let’s take the EUR/USD currency pair as an example again. If you see a quote that says “EUR/USD = 1.2300/1.2305,” the bid price is 1.2300, and the ask price is 1.2305. The bid price is always lower than the ask price.

The Importance of Bid and Ask Prices in Forex Trading

Understanding bid and ask prices is crucial for several reasons. Firstly, the bid-ask spread affects your trading costs. The narrower the spread, the better it is for traders, as it reduces the expenses of entering and exiting trades. Secondly, bid and ask prices provide insights into market liquidity. If the spread is wider, it may indicate lower liquidity, which could impact trade execution.

Tips for Effective Bid and Ask Price Analysis

To make the most of bid and ask prices, it’s essential to analyze them effectively. Keep an eye on bid and ask price movements to identify trends and patterns. Fluctuations in the bid-ask spread can provide valuable information about market sentiment. Additionally, incorporate bid and ask prices into your risk management strategy to determine appropriate entry and exit points for your trades.

Frequently Asked Questions

How long time will it take to learn basic to intermediate Forex Trading?

Q: What are bid and ask prices in Forex trading?

- A: In Forex trading, the bid price represents the highest price a buyer is willing to pay for a currency pair, while the ask price represents the lowest price a seller is willing to accept. The bid-ask spread is the difference between these two prices and serves as a transaction cost. For example, if the bid price for EUR/USD is 1.2300 and the ask price is 1.2305, the spread is 0.0005 or 5 pips. Understanding bid and ask prices is crucial for assessing market liquidity and making informed trading decisions.

Q: Why are bid and ask prices important in Forex trading?

- A: Bid and ask prices play a significant role in Forex trading. Firstly, they determine the bid-ask spread, which affects trading costs and potential profits. A narrower spread is generally preferable as it reduces expenses. Secondly, bid and ask prices provide insights into market liquidity. Wider spreads may indicate lower liquidity, which can impact trade execution. Additionally, bid and ask prices help traders determine the entry and exit points for their trades, enabling effective risk management and trade planning.

Q: How do bid and ask prices affect Forex quotes?

- A: Forex quotes display both the bid and ask prices for a currency pair. The bid price is always lower than the ask price. For instance, if a quote shows EUR/USD = 1.2300/1.2305, the bid price is 1.2300, and the ask price is 1.2305. These prices reflect the buying and selling prices in the market. Traders can use these quotes to decide whether to buy (at the ask price) or sell (at the bid price) a particular currency pair. The difference between the bid and ask prices is the bid-ask spread, which represents the transaction cost.

Q: How can I analyze bid and ask prices effectively in Forex trading?

- A: To analyze bid and ask prices effectively, and monitor their movements over time. Pay attention to trends and patterns in the bid-ask spread, as wider or narrower spreads can indicate changes in market sentiment. Fluctuations in the spread can provide insights into market liquidity and trading conditions. Additionally, consider incorporating bid and ask prices into your risk management strategy. By analyzing the bid-ask spread and its impact on your trading costs, you can determine optimal entry and exit points for your trades, enhancing your overall trading performance.

Ok, it is very clear what is Bid and Ask Prices in Forex, Now it’s time for me to open a trading account with a reputable broker to try my demo or real account to warm up my practice.

Conclusion of Bid and Ask Prices in Forex

Bid and ask prices are fundamental aspects of Forex trading. Understanding their meaning, significance, and impact on your trades is essential for success in the Forex market. By closely monitoring bid and ask prices, analyzing trends, and utilizing this information in your trading decisions, you can enhance your trading skills and make more informed choices.

What are the potential benefits of Forex trading?

[table id=2 /]We value your input and perspective! We encourage you to share your thoughts and opinions on this topic by leaving a comment below. Whether you have a question, additional insight, or a personal experience related to bid and ask prices in Forex trading, we would love to hear from you. Your comments not only contribute to the ongoing conversation but also help create a vibrant community of like-minded individuals who are passionate about Forex trading. So, don’t hesitate to join the discussion and share your valuable input with us. We look forward to hearing from you!