[What are Stop-Loss and Take-Profit Orders in Forex Trading?] Stop-loss and take-profit orders are essential tools in Forex trading that help manage risks and protect profits. A stop-loss order is a predetermined price level at which you exit a trade to limit potential losses. On the other hand, a take-profit order is a predefined price level at which you exit a trade to secure profits. These orders are like your safety nets in the volatile Forex market, ensuring that you don’t suffer significant losses or miss out on potential gains.

Tip 1: Setting Clear Objectives

Setting clear objectives is crucial when utilizing stop-loss and take-profit orders. Start by determining your risk appetite, which means understanding how much loss you are willing to tolerate in a trade. For example, if you are comfortable with a 2% loss on a trade, you can set your stop-loss order at a level that limits your potential loss to that percentage.

Defining profit targets is equally important. Consider how much profit you want to achieve from trade and set your take-profit order accordingly. Let’s say you aim for a 5% profit, you can set your take-profit order at a price level that ensures you exit the trade once that target is reached.

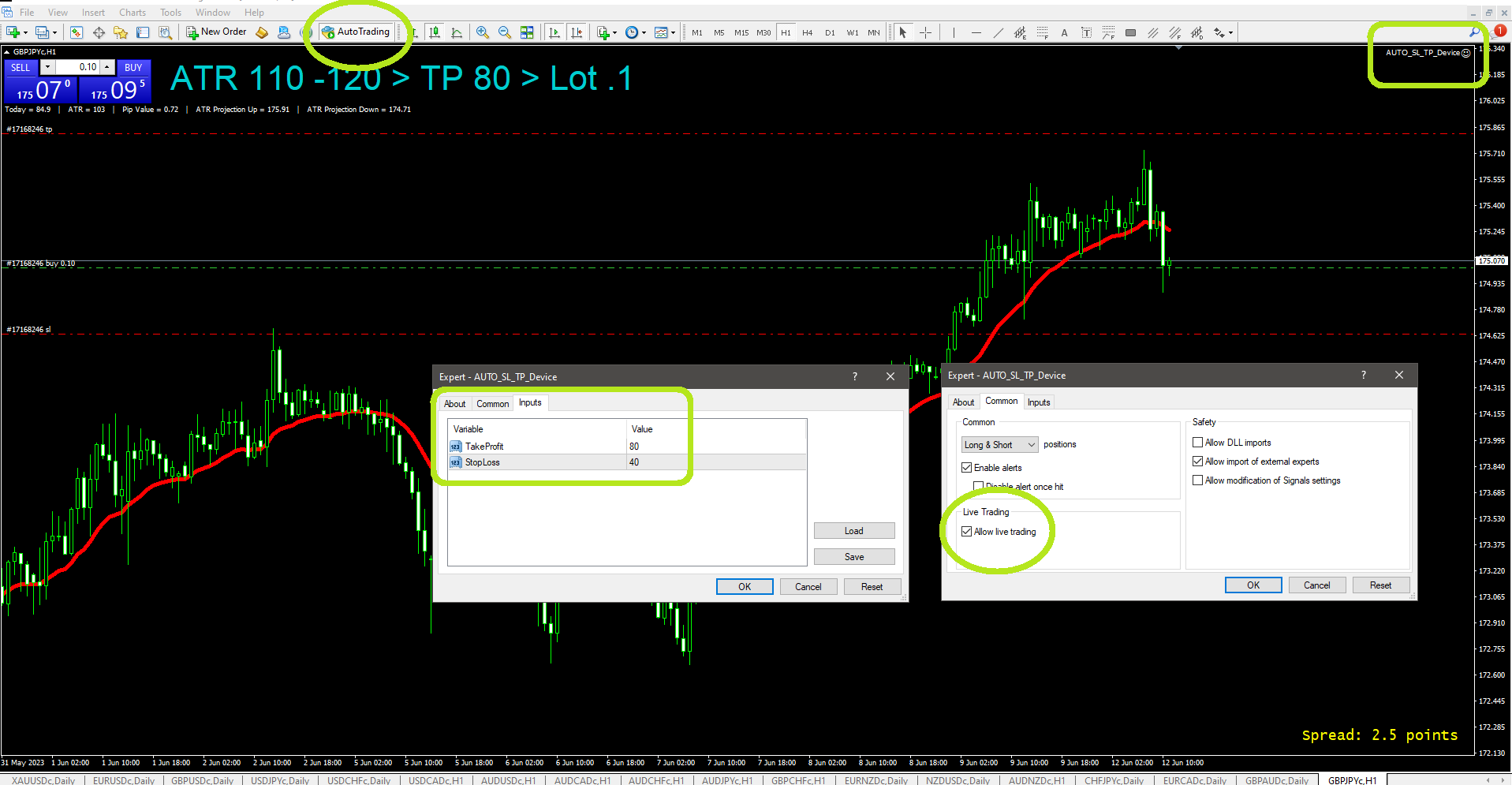

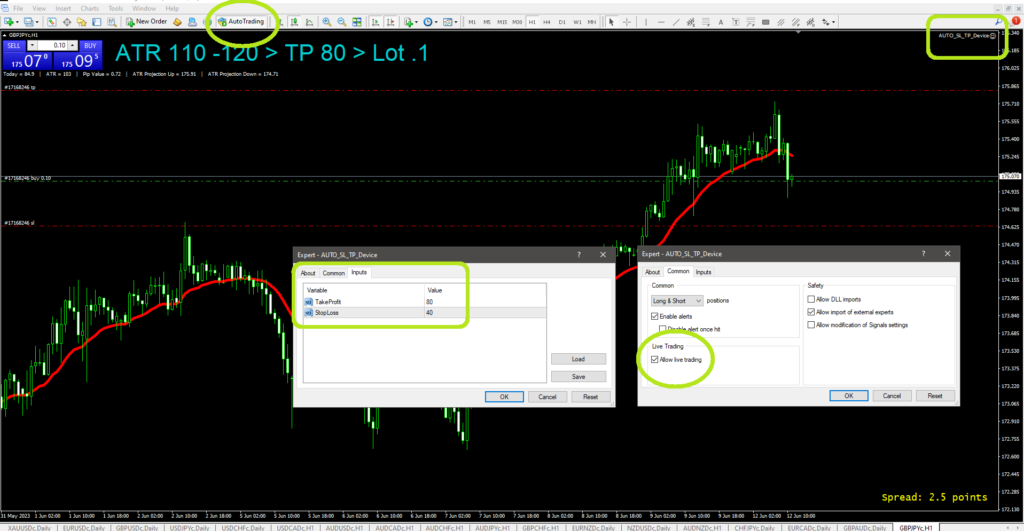

Auto stop-loss and take-profit EA made my Forex journey easy, I do not need to set up individual orders stop-loss or take-profit, This EA set it automatically. End of the post you will get the download link.

Tip 2: Understanding Market Volatility

Market volatility plays a significant role in Forex trading, and it’s important to consider it when utilizing stop-loss and take-profit orders. Volatility indicators such as Average True Range (ATR) can help you assess the market’s current volatility. By analyzing these indicators, you can adjust your stop-loss and take-profit levels accordingly. For instance, in a highly volatile market, you might need to widen your stop-loss level to allow for larger price fluctuations.

Before you begin trading Forex, it’s essential to get to know your broker thoroughly. Trustworthy brokers always prioritize protecting their client’s interests and never manipulate stop-loss orders. Be cautious of brokers with a bad reputation for engaging in such dishonest practices.

Tip 3: Proper Position Sizing

Proper position sizing is essential for effective risk management when using stop-loss and take-profit orders. Calculate your position size based on the risk-reward ratio you’re comfortable with. For example, if you’re willing to risk 1% of your trading capital on a trade with a potential 3% reward, you can adjust your position size accordingly.

Position size calculators are helpful tools that can assist you in determining the appropriate position size based on your risk parameters. They take into account factors such as your account balance, stop-loss level, and risk percentage to provide you with the optimal position size for a trade.

What are the potential benefits of Forex trading?

Tip 4: Trailing Stop-Loss Orders

Trailing stop-loss orders is an advanced technique that can help you lock in profits as the market moves in your favor. A trailing stop-loss order follows the price in the direction of your trade, automatically adjusting the stop-loss level to protect your gains. For example, if you set a trailing stop-loss order with a 20-pip trail and the market moves 30 pips in your favor, the stop-loss level will be adjusted 20 pips behind the current market price, securing at least a 10-pip profit even if the market reverses.

Tip 5: Regular Monitoring and Adjustment

Regularly monitoring your trades and adjusting stop-loss and take-profit levels is crucial for successful Forex trading. Keep a close eye on market conditions and price movements. If the market starts showing signs of reversing, consider adjusting your stop-loss level to protect your profits or limit potential losses. Similarly, if the market continues to move in your favor, it might be wise to adjust your take-profit level to secure more significant gains.

Tip 6: Implementing Stop-Loss and Take-Profit Orders on Trading Platforms

What are the risks involved in Forex trading?

Implementing stop-loss and take-profit orders on trading platforms is a straightforward process. Let’s take MetaTrader 4 as an example. After opening a trade, you can right-click on the open position on the platform, select “Modify or Delete Order,” and set your stop-loss and take-profit levels. Customizing order parameters allows you to fine-tune your risk management strategy, adjusting parameters like the order type, execution mode, and order expiration.

Tip 7: Learning from Past Trades and Adjusting Strategies

Learning from past trades and adjusting your strategies is vital for continuous improvement in Forex trading. Keep a trading journal where you record the details of your trades, including the use of stop-loss and take-profit orders. Regularly review your journal to analyze your trade data and performance. By identifying patterns and trends, you can refine your strategies and adapt to changing market conditions, increasing your chances of success.

Frequently Asked Questions

How much capital do I need to start Forex trading?

Q: What is a stop-loss order?

- A stop-loss order is a predefined price level at which you exit a trade to limit potential losses. It acts as a safety net to protect your capital by automatically closing the trade if the market moves against your position beyond a certain point.

Q: What is a take-profit order? A:

- take-profit order is a predetermined price level at which you exit a trade to secure profits. It allows you to set a target price at which your trade will automatically close, ensuring that you lock in gains when the market reaches your desired level.

Q: How do stop-loss and take-profit orders help manage risks?

- Stop-loss and take-profit orders are risk management tools. A stop-loss order helps limit potential losses by closing a trade if the market moves against your position beyond a specified level. A take-profit order allows you to secure profits by closing a trade when the market reaches your target price, protecting your gains from potential reversals.

Q: Should I always use stop-loss and take-profit orders?

- While stop-loss and take-profit orders are beneficial, their usage depends on your trading strategy and risk tolerance. They provide a disciplined approach to risk management and can help protect your capital and secure profits. However, there may be instances where you choose to manually exit trades based on real-time market analysis and conditions.

Q: Can I adjust stop-loss and take-profit levels after placing an order?

- Yes, you can adjust stop-loss and take-profit levels after placing an order. Many trading platforms allow you to modify orders, enabling you to move the stop-loss and take-profit levels to reflect changes in market conditions or your trading strategy. It’s important to regularly monitor your trades and make adjustments as needed.

Q: What is the difference between a trailing stop-loss order and a regular stop-loss order?

- A trailing stop-loss order is a dynamic order that adjusts the stop-loss level as the market moves in your favor. It allows you to lock in profits by trailing the stop-loss level behind the current market price. In contrast, a regular stop-loss order has a fixed price level and does not automatically adjust as the market moves.

Q: Are stop-loss and take-profit orders guaranteed to be executed at the specified levels?

- While stop-loss and take-profit orders are designed to be executed at the specified levels, certain market conditions

Conclusion of Stop-Loss and Take-Profit Orders in Forex Trading

In conclusion, utilizing stop-loss and take-profit orders is essential for effective risk management and maximizing profits in Forex trading. By setting clear objectives, understanding market volatility, practicing proper position sizing, using trailing stop-loss orders, regularly monitoring and adjusting trades, implementing orders on trading platforms, and learning from past trades, you can enhance your trading strategy and achieve better results. Remember, the key is to develop a disciplined approach and adapt your strategies based on market conditions to succeed in the exciting world of Forex trading.

such as price gaps or slippage can affect the execution. In highly volatile markets, the execution may occur at a different price than the one initially set. It’s important to be aware of these possibilities and consider them when setting your orders.

If you’re interested in the custom Auto stop-loss and take-profit EA in Forex trading, follow the google drive link to download

[lockercat] Download Auto stop-loss and take-profit EA [/lockercat]

How to Use Forex Custom Indicators, Templates, and Profiles in MT4?

[table id=2 /]We value your input and insights! We invite you to share your thoughts and experiences regarding stop-loss and take-profit orders in Forex trading. Whether you have questions, success stories, or additional tips to offer, your comments can contribute to a vibrant and collaborative discussion. We believe that engaging with our readers creates a valuable community where we can learn from one another. So, don’t hesitate to leave a comment below and join the conversation. We look forward to hearing from you!