Forex trading involves analyzing various indicators to predict market movements and make informed trading decisions. One of the most powerful tools in a trader’s arsenal is the study of Forex chart patterns. These patterns offer valuable insights into potential price movements, helping traders spot both trend reversals and continuation signals. In this article, we’ll explore ten key Forex chart patterns, providing clear explanations and real-life examples to make understanding these patterns easier for traders of all levels.

Reversal Chart Patterns

Which Forex broker is reliable for Forex trading and has less spread and instant withdrawal?

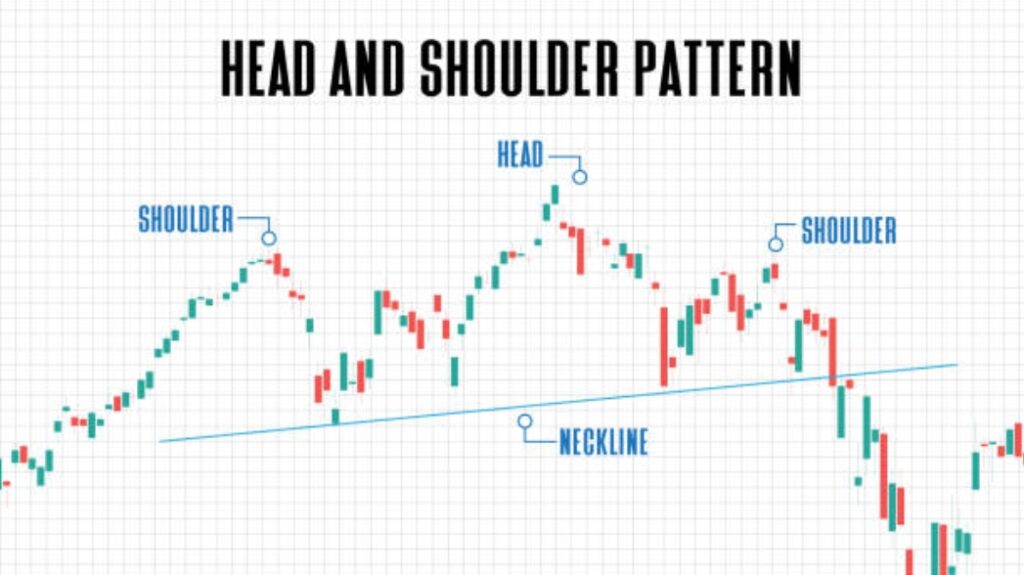

Head and Shoulders:

The head and shoulders pattern is a reliable trend reversal indicator. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). The pattern signals a potential shift from an uptrend to a downtrend or vice versa. Let’s take a look at a real-life example:

In this example, the head and shoulders pattern formed after a prolonged uptrend. Once the price broke below the neckline (the line connecting the two shoulders), it confirmed the trend reversal, leading to a bearish move.

Double Tops and Double Bottoms:

Double tops and double bottoms are reversal patterns that form after an uptrend or downtrend, respectively. A double top consists of two peaks at roughly the same price level, while a double bottom comprises two troughs at approximately the same level. These patterns suggest a potential reversal in the current trend. Here’s a practical illustration:

In this example, we can observe both a double top and a double bottom pattern. The double top signals a shift from an uptrend to a downtrend, while the double bottom indicates a shift from a downtrend to an uptrend.

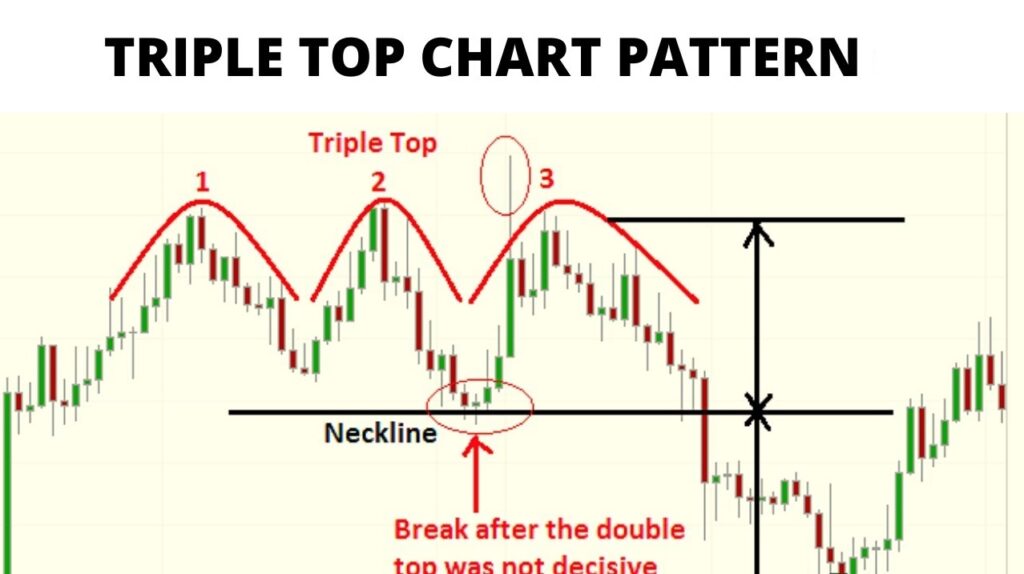

Triple Tops and Triple Bottoms:

Triple tops and triple bottoms are similar to double tops and double bottoms but involve three peaks or troughs. They indicate even stronger potential reversals in the current trend. Here’s an example:

In this case, we see a triple top formation, which preceded a significant downtrend as the price broke below the support level.

Continuation Chart Patterns

CL2. What is the Forex market and how does it’s work?

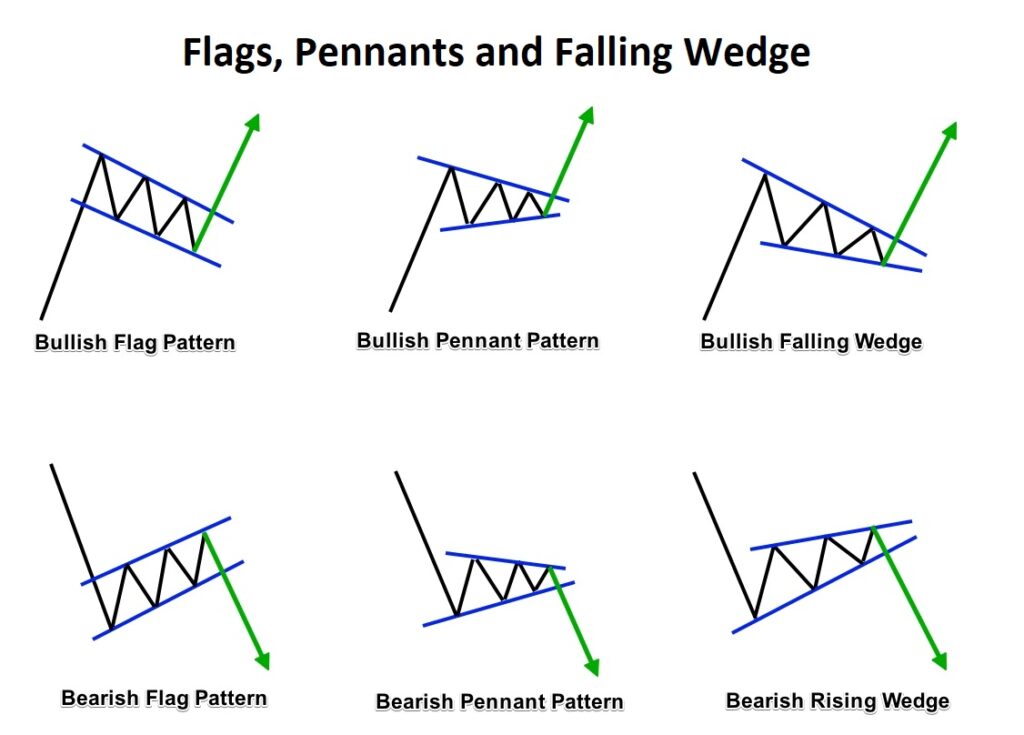

Flags and Pennants:

Flags and pennants are continuation patterns that occur after strong price moves. A flag resembles a small rectangle, while a pennant looks like a small symmetrical triangle. These patterns suggest that the market is taking a breather before resuming the previous trend. Let’s see a real-life example:

In this example, we can observe both a flag and a pennant pattern. After a sharp upward move, the price consolidated within the flag and pennant formations before continuing its uptrend.

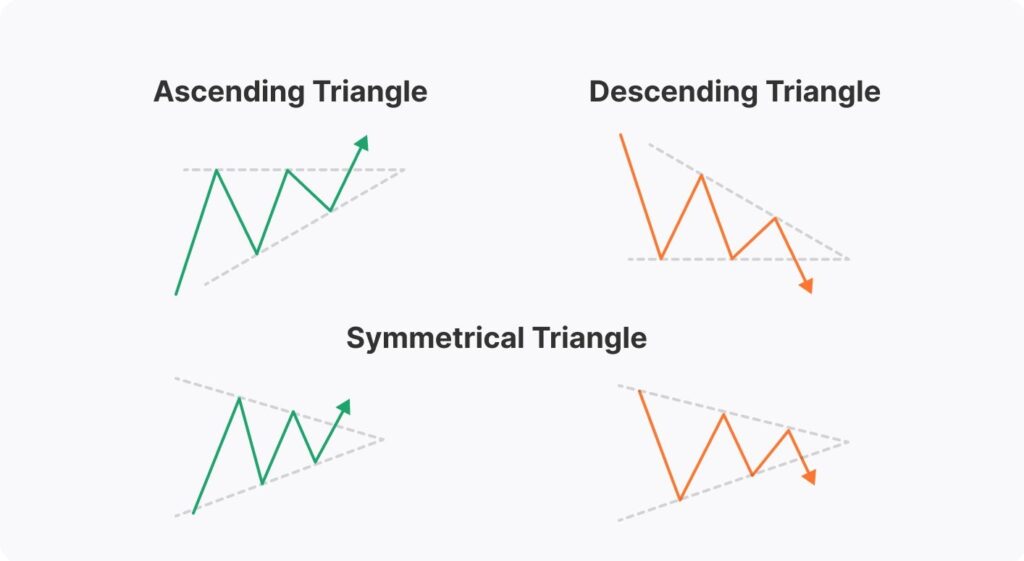

Symmetrical Triangles:

Symmetrical triangles are continuation patterns that show a period of consolidation before a potential trend continuation. These triangles have converging trendlines and imply an imminent breakout. Let’s examine an illustration:

In this example, the symmetrical triangle formed during a downtrend. Once the price broke above the upper trendline, it confirmed the continuation of the upward movement.

Ascending and Descending Triangles:

Ascending triangles and descending triangles are also continuation patterns. An ascending triangle features a horizontal resistance line and an upward-sloping support line, while a descending triangle has a horizontal support line and a downward-sloping resistance line. Let’s explore an example:

In this instance, both ascending and descending triangles are present. The ascending triangle preceded an upward breakout, while the descending triangle led to a downward breakout.

Combining Chart Patterns with Other Technical Indicators

CL4. What are Support Resistance and Chart types in Forex trading?

Successful Forex trading often involves combining chart patterns with other technical indicators for better confirmation and accuracy. Here are some popular indicators to consider:

- Moving Averages: Moving averages help smooth out price fluctuations and identify trends. Combining moving averages with chart patterns can provide additional confirmation of potential trend reversals or continuations.

- RSI (Relative Strength Index): The RSI measures the strength of price movements and can signal overbought or oversold conditions. When RSI aligns with a chart pattern’s signals, it strengthens the overall trading strategy.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following indicator that highlights the relationship between two moving averages. When used with chart patterns, it can offer insights into trend direction and momentum.

Tips for Chart Pattern Trading

How to Use Forex Custom Indicators, Templates, and Profiles in MT4?

- Risk Management: Set appropriate stop-loss levels to protect your capital in case the market moves against your trade.

- Setting Proper Stop-Loss and Take-Profit Levels: Determine your risk-reward ratio and identify suitable points to exit trades both in profit and loss scenarios.

- Practicing Patience and Discipline: Be patient and wait for strong chart pattern confirmations before entering a trade. Stick to your trading plan and avoid emotional decisions.

Frequently Asked Questions

Q: What are the most common Forex chart patterns?

- A: The most common Forex chart patterns include head and shoulders, double tops, double bottoms, ascending triangles, and flags. These patterns provide valuable insights into potential price movements and can be used to identify both trend reversals and continuation signals.

Q: How can I trade Forex chart patterns effectively?

- A: To trade Forex chart patterns effectively, start by identifying the pattern and wait for a clear breakout confirmation. Use additional technical indicators like moving averages and RSI to strengthen your analysis. Set proper stop-loss and take-profit levels, practice patience, and stick to your trading plan.

Q: What is the difference between a continuation pattern and a reversal pattern?

- A: A continuation pattern indicates a temporary pause in the current trend before it continues in the same direction. Examples include flags and pennants. On the other hand, a reversal pattern signals a potential change in the current trend. Examples include head and shoulders and double tops/bottoms.

Q: Can I rely solely on chart patterns for Forex trading?

- A: While chart patterns are powerful tools, relying solely on them for Forex trading is not recommended. It’s essential to consider other factors like fundamental analysis, market sentiment, and economic indicators to make well-informed trading decisions.

Q: How do I avoid false signals in Forex chart patterns?

- A: To avoid false signals, look for patterns that are well-defined and have strong breakout confirmations. Consider using multiple time frames for analysis to increase accuracy. Combining chart patterns with other technical indicators can also help filter out false signals and improve your trading success.

Conclusion

Forex chart patterns provide valuable insights into market behavior, offering traders the opportunity to identify trend reversals and continuations. By understanding these patterns and combining them with other technical indicators, traders can enhance their trading strategies and make more informed decisions. Remember, practice and discipline are key to mastering chart pattern trading, so keep honing your skills and stay dedicated to becoming a successful Forex trader.

Do you need a Deep Road Map for Forex learning? Structural Forex Trading Learning Road Map

We hope you found our article on “Mastering Forex Chart Patterns: Identifying Reversal and Continuation Signals” insightful and informative. We believe that your thoughts, experiences, and questions are invaluable to the trading community. We invite you to share your feedback, ideas, and any additional chart patterns you’ve come across in the Forex market. Your comments will not only enrich our content but also foster a collaborative learning environment for all traders. So, don’t hesitate to join the discussion, and let’s grow together as knowledgeable and successful Forex traders. We look forward to hearing from you!