[How to calculate Forex pip value in different currency pairs?] Understanding how to calculate Forex pip values is crucial for Forex traders. Pip value is a key concept in determining the potential profit or loss of a trade. In this blog post, we will guide you through the process of calculating pip values in different currency pairs, providing you with a step-by-step approach that is easy to follow. What is Forex trading?

“If you prefer the audio version of this blog article, please follow this Youtube link.“

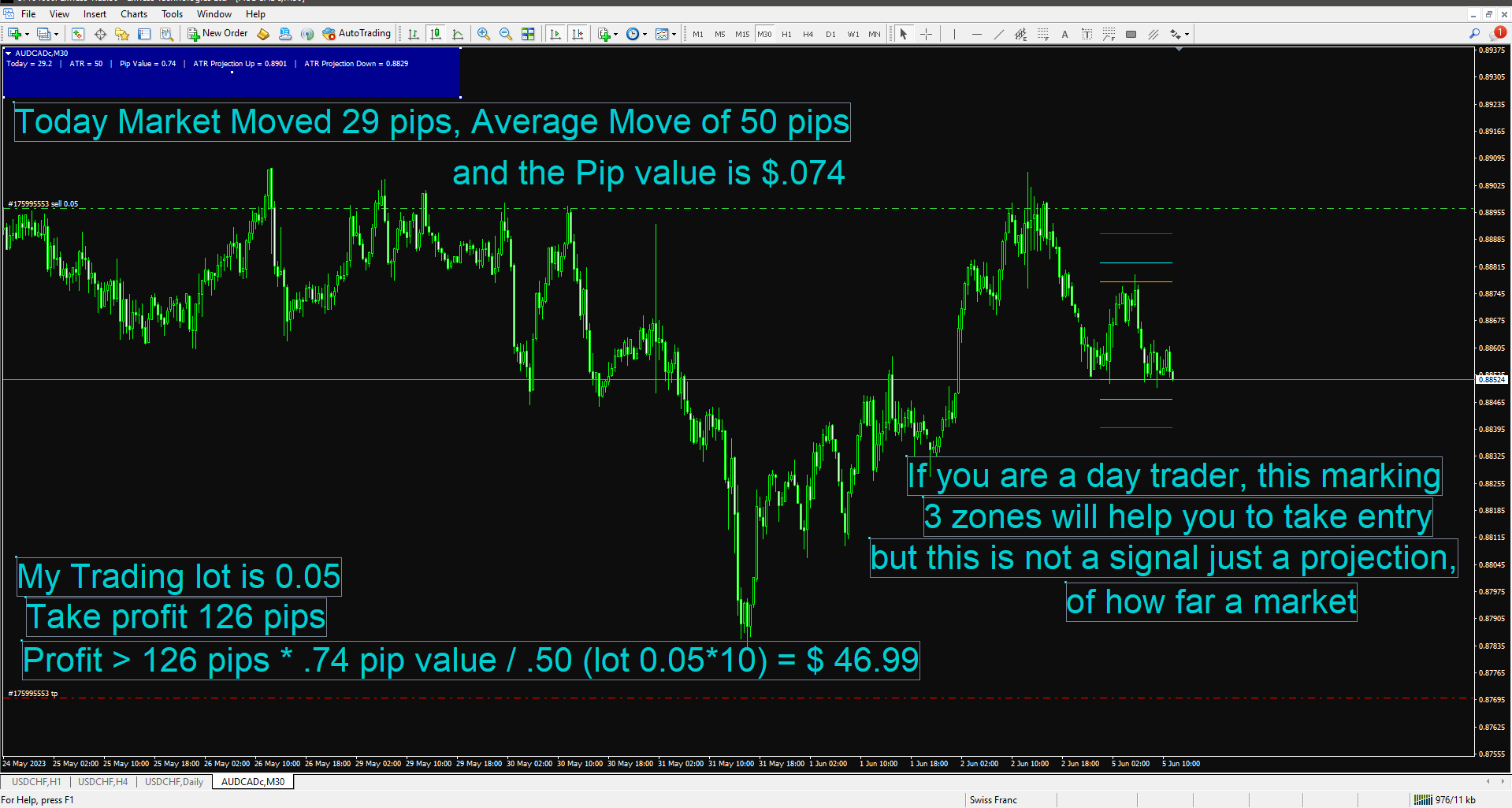

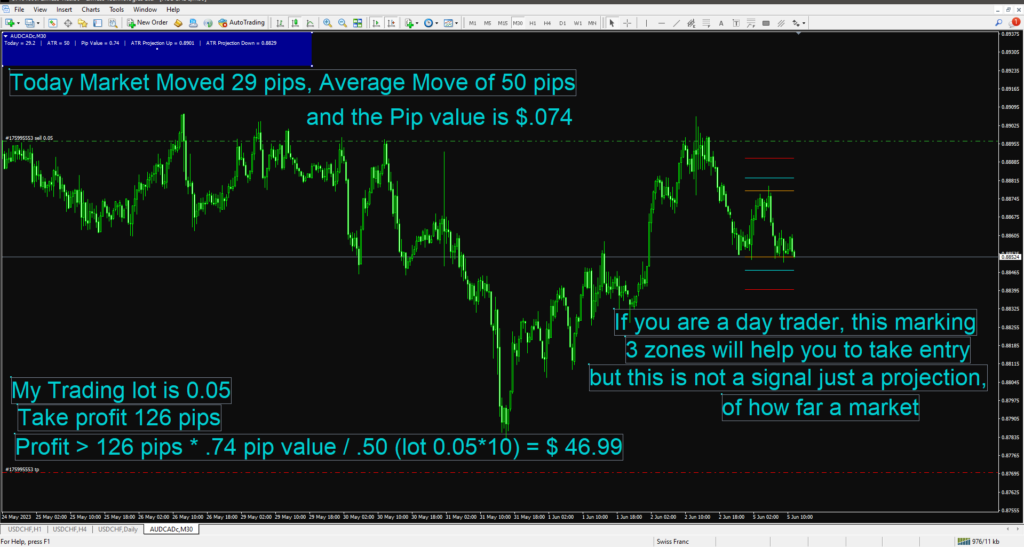

As you can see in the feature image on top I am using the ATR_projection custom indicator. At the end of the post, you will get the download link.

What is a Pip?

Before we dive into the calculation process, let’s clarify what a pip is. A pip, short for “percentage in point,” represents the smallest unit of price movement in a currency pair. For most currency pairs, it refers to the fourth decimal place, except for pairs involving the Japanese yen, where it refers to the second decimal place.

Understanding Currency Pairs

What are the potential benefits of Forex trading?

To calculate pip values accurately, it is important to understand how currency pairs are quoted. Currency pairs are expressed as a combination of two currencies, with one currency being the base currency and the other as the quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency.

Factors Affecting Pip Value Calculation

Several factors influence the calculation of pip values. Firstly, the lot size you trade determines the value of each pip movement. Standard lots, mini lots, and micro-lots have different pip values. Additionally, exchange rates play a significant role. The value of a pip in your trading account currency depends on the exchange rate between the quote currency and your account currency.

Step-by-Step Guide to Calculating Pip Values

Now, let’s walk through the process of calculating pip values in different currency pairs using a step-by-step approach:

- Step 1: Determine the Quote Currency: Identify the currency in the currency pair that is listed second. This currency will be the quote currency.

- Step 2: Identify the Pip Location: Determine the decimal place where the pip is located in the quote currency. For most pairs, it is the fourth decimal place, but for yen pairs, it is the second decimal place.

- Step 3: Determine the Exchange Rate: Find the current exchange rate for the currency pair you are trading. This information is readily available on forex platforms or financial websites.

- Step 4: Calculate the Pip Value: Multiply the pip location by the lot size to calculate the pip value in the quote currency. For example, if the pip location is 0.0001 and you are trading one standard lot (100,000 units), the pip value would be 10 units of the quote currency.

- Step 5: Adjusting for Lot Size: If you are trading a mini lot (10,000 units) or a micro lot (1,000 units), adjust the pip value accordingly. Divide the pip value by 10 for mini lots or by 100 for micro lots.

- Step 6: Consider the Currency of Your Trading Account: If your trading account is denominated in a different currency than the quote currency, you need to convert the pip value to your account currency using the current exchange rate.

- Step 7: Putting it All Together: After completing the calculations for steps 4, 5, and 6, you have determined the pip value in your account currency. This value represents the monetary impact of a one-pip movement in the currency pair you are trading.

Example: Let’s say you are trading the GBP/USD pair with a standard lot size of 100,000 units. The current exchange rate is 1.3000, and the pip location for GBP/USD is 0.0001. To calculate the pip value, you multiply 0.0001 by 100,000, resulting in a pip value of $10. If your trading account is denominated in euros (EUR), you would need to convert the pip value to euros using the EUR/USD exchange rate.

Ok, I got it what is Forex pip value, Now it’s time for me to open a trading account with a reputable broker to try my demo or real account to warm up my practice.

Tips and Best Practices

- Double-check your calculations to ensure accuracy.

- Use a pip value calculator or automated trading platforms that provide pip value information.

- Keep track of exchange rate fluctuations as they can impact pip values.

- Regularly review and update your pip value calculations if lot sizes or exchange rates change.

Frequently Asked Questions

Q1: What is the significance of calculating pip values in forex trading?

- A1: Calculating pip values helps traders determine the potential profit or loss of a trade. It allows them to manage risk effectively by understanding the monetary impact of price movements in a currency pair.

Q2: How do I determine the pip location in a currency pair?

- A2: For most currency pairs, the pip location is the fourth decimal place, except for yen pairs, where it is the second decimal place. Identifying the pip location is crucial for accurately calculating pip values.

Q3: How does lot size affect pip values?

- A3: Lot size determines the value of each pip movement. Standard lots, mini lots, and micro-lots have different pip values. A larger lot size will result in a higher pip value, while a smaller lot size will have a lower pip value.

Q4: What if my trading account is denominated in a different currency than the quote currency?

- A4: In such cases, you need to convert the pip value to your account currency using the current exchange rate. This ensures that you have a clear understanding of the pip value in terms of your trading account’s currency.

Q5: Are there any online tools available to calculate pip values?

- A5: Yes, there are numerous online pip value calculators that simplify the calculation process. These tools allow you to input the necessary details such as lot size and currency pair, and they provide you with the pip value instantly.

Q6: How often should I update my pip value calculations?

- A6: It is advisable to review and update your pip value calculations whenever there are changes in lot sizes or exchange rates. Regularly monitoring these factors ensures that your pip value calculations remain accurate and up to date.

Q7: Can I automate the pip value calculation process?

- A7: Yes, many trading platforms and software offer automated pip value calculation features. These tools save time and provide accurate pip value information, allowing you to focus on your trading strategies.

Q8: Is it necessary to calculate pip values for every trade?

- A8: Calculating pip values is particularly important for risk management in forex trading. While it may not be necessary for every trade, having a clear understanding of pip values helps you make informed decisions and manage your trades effectively.

Q9: Are there any common mistakes to avoid when calculating pip values?

- A9: One common mistake is forgetting to adjust the pip value for different lot sizes. It’s essential to divide the pip value by 10 for mini lots and by 100 for micro lots. Additionally, double-checking calculations and using accurate exchange rates are crucial to avoid errors.

Q10: Can I rely solely on automated pip value calculators?

- A10: While automated pip value calculators are convenient, it is still important to have a basic understanding of the calculation process. This allows you to verify the accuracy of the calculated values and ensures you can manually perform the calculations if needed.

If you’re interested in the custom indicator ATR_projection follow the google drive link to download [lockercat] Download ATR_projection [/lockercat]

How to Use Forex Custom Indicators, Templates, and Profiles in MT4?

Conclusion of Calculate Forex Pip Values

Calculating pip values is an essential skill for forex traders. By following the step-by-step approach outlined in this blog post, you can accurately determine the pip value for different currency pairs. Understanding pip values enables you to manage risk effectively and make informed trading decisions.

Remember, practice is key to mastering this skill. As you gain experience, calculating pip values will become second nature, allowing you to navigate the forex market with confidence.

Forex Learning Road Map to Become a Successful Forex Trader

[table id=2 /]We value your feedback and insights! We invite you to share your thoughts and experiences related to calculating forex pip values in the comment section below. Whether you have additional tips to add or questions to ask, we encourage an open dialogue to foster learning and collaboration within our community. Your comments are highly appreciated, and we look forward to engaging with you!