Welcome to Forex Class 3: Mastering the Power of Forex Fundamental Analysis. In this class, we’ll dive into the world of fundamental analysis and explore its significance in Forex trading. Understanding fundamental analysis is crucial for making informed trading decisions and potentially increasing profitability.

Forex Trading Learning Road Map

What is Fundamental Analysis?

Fundamental analysis is a method of evaluating the true value of a currency by considering economic, financial, and geopolitical factors. It focuses on understanding the real-world forces that drive currency price movements. By studying these factors, traders aim to identify currencies that may be undervalued or overvalued, helping them make better trading decisions based on the current economic conditions. If you are interested to know the most reputable Forex broker to open an account.

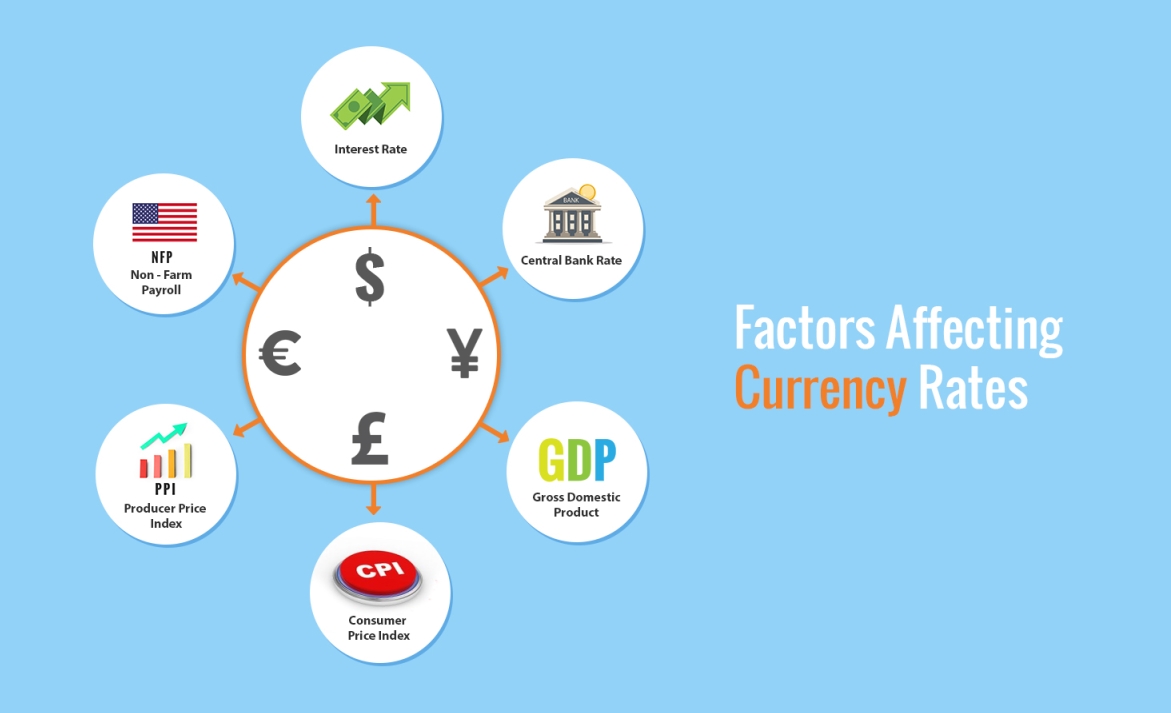

Economic Indicators and Their Impact on Currencies

Economic indicators are statistics that provide insights into a country’s economic health and performance. By paying attention to these indicators, traders can get a sense of the overall economic conditions and make more informed decisions. Some important economic indicators

- include Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- unemployment rate

- interest rates

- trade balance and Current Account

GDP (Gross Domestic Product)

Let’s consider Gross Domestic Product (GDP) as an example. GDP measures the total value of goods and services produced within a country. When a country experiences positive GDP growth, it indicates a robust economy, often leading to increased demand for its currency. As a result, the currency tends to strengthen. On the other hand, if a country’s GDP growth slows down or contracts, it may weaken the currency.

CPI (Consumer Price Index)

Another example is the Consumer Price Index (CPI), which measures inflation. Higher inflation can prompt central banks to raise interest rates to control it. This, in turn, can attract foreign investors seeking higher returns on their investments, ultimately strengthening the currency. Understanding how economic indicators influence currency values is crucial for Forex traders.

Employment Data and Its Impact on Currency Values

Forex Class 1: A Comprehensive Introduction to Beginner Forex Trading

When it comes to fundamental analysis in Forex trading, employment data plays a crucial role in evaluating the health of an economy. Two key employment indicators that traders closely monitor are the unemployment rate and non-farm payrolls.

- The Unemployment Rate: The unemployment rate measures the percentage of the labor force that is currently unemployed and actively seeking employment. A lower unemployment rate indicates a healthier job market and often reflects positive economic conditions. As more people find jobs, consumer spending and economic growth tend to increase, leading to a stronger currency. On the other hand, a higher unemployment rate suggests economic weakness, potentially leading to a weaker currency.

- Non-Farm Payrolls: Non-farm payrolls refer to the number of jobs added or lost in the economy, excluding agricultural and government employment. It is released monthly by the U.S. Bureau of Labor Statistics and is considered a significant economic indicator. Traders pay close attention to the non-farm payrolls report as it provides insights into the overall employment trend in the country. A higher-than-expected increase in non-farm payrolls is generally positive for the currency, indicating economic growth and potential currency strength. Conversely, a lower-than-expected increase or a decline in non-farm payrolls can negatively impact the currency, suggesting economic slowdown or weakness.

Example: Let’s consider a hypothetical scenario where the U.S. releases its monthly employment data. The non-farm payrolls report shows a significant increase of 300,000 jobs, surpassing market expectations of 200,000 jobs. Simultaneously, the unemployment rate drops from 5.0% to 4.5%. These positive employment figures indicate a strong labor market and potential economic growth. As a result, the U.S. dollar (USD) may strengthen against other currencies in the Forex market. Traders who anticipated this outcome and positioned themselves accordingly could benefit from the currency’s upward movement.

It’s important to note that employment data releases can be volatile and may lead to sudden price movements in the Forex market. Traders should exercise caution and implement risk management strategies to protect their positions during these periods of increased market volatility.

Interest Rates and Central Bank Decisions

In the world of Forex trading, interest rates, and central bank decisions hold significant importance. Central banks, such as the Federal Reserve (Fed) in the United States or the European Central Bank (ECB) in the Eurozone, have the power to influence interest rates and make decisions that can impact currency values. Let’s explore how interest rates and central bank decisions can affect the Forex market.

- Interest Rates and Currency Values: Interest rates play a crucial role in determining the attractiveness of a currency to investors. Higher interest rates generally attract foreign investors seeking higher returns on their investments. This increased demand for the currency can lead to its appreciation in value. Conversely, lower interest rates may make a currency less appealing to investors, potentially resulting in a depreciation of its value.

- Central Bank Decisions: Central banks have the authority to adjust interest rates and implement monetary policies to achieve certain economic goals. These decisions can have a profound impact on currency values.

For example, if a central bank decides to raise interest rates, it often signals confidence in the economy’s strength and stability. This move can attract foreign capital, leading to increased demand for the currency and potential currency appreciation.

On the other hand, if a central bank opts to lower interest rates, it may aim to stimulate economic growth by making borrowing cheaper and encouraging consumer spending. However, a reduction in interest rates can also make a currency less attractive to investors, potentially resulting in currency depreciation.

Forex Class 2: A Comprehensive Guide to Understanding the Forex Market Basics

- Market Expectations and Central Bank Decisions: Forex traders closely monitor central bank announcements and their decisions regarding interest rates. Market expectations play a significant role in determining how currency values react to these decisions. If a central bank’s decision aligns with market expectations, the currency’s response may be relatively muted. However, if the decision surprises the market, it can trigger significant volatility and lead to substantial currency movements.

Example: Let’s consider a hypothetical scenario where the Bank of England (BoE) decides to raise interest rates by 0.25%, a move that exceeds market expectations. This decision indicates the central bank’s confidence in the country’s economic performance. Consequently, the British pound (GBP) may strengthen against other currencies as investors seek higher returns in the UK due to the increased interest rates.

It’s important to note that central bank decisions are not solely based on interest rates. Central banks also consider a range of economic factors, such as inflation, employment data, and overall economic growth, when making their decisions.

Trade Balance and Current Account:

When it comes to fundamental analysis in Forex trading, two important economic indicators to consider are the trade balance and the current account. These indicators provide insights into a country’s international trade and its impact on the currency’s value. Let’s explore their significance and how they can influence Forex markets.

- Trade Balance: The trade balance measures the difference between a country’s exports and imports of goods and services over a specific period. A positive trade balance, also known as a trade surplus, occurs when a country’s exports exceed its imports. Conversely, a negative trade balance, or a trade deficit, arises when imports surpass exports.

- Impact on Currency Values: The trade balance can have a significant impact on a country’s currency value. A positive trade balance indicates that a country is exporting more than it imports, suggesting economic strength and competitiveness. This surplus can increase demand for the country’s currency, leading to currency appreciation. On the other hand, a negative trade balance may raise concerns about a country’s economic competitiveness, potentially resulting in currency depreciation.

Example: Let’s consider a hypothetical scenario where Country A has a trade surplus due to strong exports in industries like technology and manufacturing. This positive trade balance signifies a robust economy and indicates that Country A is earning more foreign currency through exports than it is spending on imports. Consequently, the value of Country A’s currency may strengthen in the Forex market.

- Current Account: The current account is a broader measure that includes not only the trade balance but also other cross-border transactions, such as services, income from investments, and unilateral transfers. It provides a comprehensive view of a country’s overall economic relationship with the rest of the world.

- Impact on Currency Values: Similar to the trade balance, the current account can influence currency values. A surplus in the current account suggests that a country is earning more from its international transactions than it is spending. This surplus reflects positive economic conditions and can lead to currency appreciation. Conversely, a deficit in the current account may indicate economic weakness and potentially result in currency depreciation.

Example: Let’s continue with the example of Country A. In addition to a trade surplus, Country A also has a current account surplus due to its strong performance in various sectors. This surplus indicates that Country A is earning more from international transactions, including services and investments than it is spending. As a result, the value of Country A’s currency may further strengthen in the Forex market.

It’s important to note that the trade balance and current account are interrelated but represent different aspects of a country’s economic performance. While the trade balance focuses solely on goods and services, the current account provides a more comprehensive picture by including other financial flows.

By analyzing economic data releases and comparing them with market expectations, traders can anticipate potential currency movements. Positive surprises or deviations from market expectations can often lead to significant price swings. Traders use this information to adjust their trading strategies accordingly.

News Releases and Their Influence on the Market

News releases play a significant role in shaping market sentiment and driving currency price movements. They can include economic data, central bank announcements, political developments, or geopolitical events. Traders closely monitor news releases to identify trading opportunities and manage risks.

For example, central bank announcements on monetary policy decisions, such as changes in interest rates or implementation of quantitative easing programs, can have a profound impact on currency values. When a central bank decides to raise interest rates, it usually signals confidence in the economy, attracting foreign investors seeking higher returns. As a result, the currency may strengthen against other currencies.

Political Developments

Political developments, such as elections, policy changes, or geopolitical tensions, can also significantly influence market sentiment and currency values. Traders need to stay informed about such developments and assess their potential impact on the Forex market.

Strategies for Trading News Releases

When trading news releases, it’s crucial to plan carefully and manage risks effectively. Some traders prefer to trade the immediate price reaction after a news release, while others choose to wait for the initial volatility to settle before entering a trade. Implementing risk management strategies, such as using stop-loss orders or setting profit targets, is crucial during these potentially volatile periods.

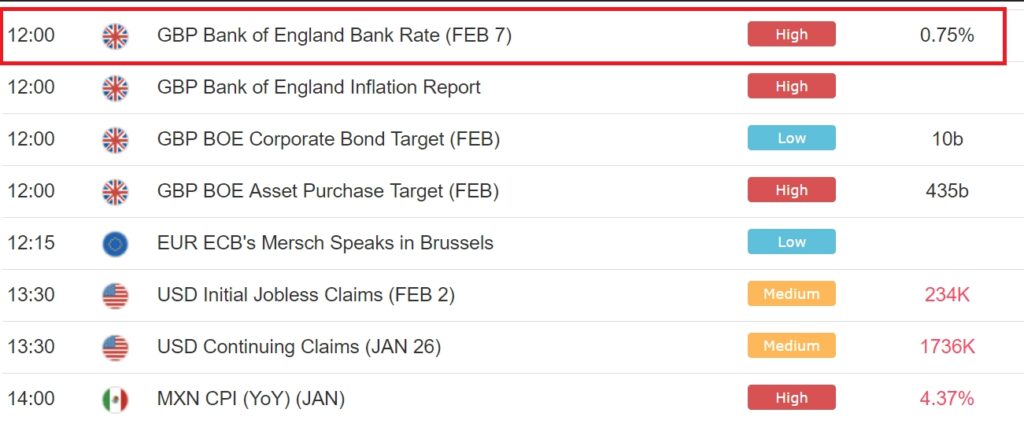

Evaluating Economic Calendars

Economic calendars provide traders with a schedule of upcoming economic events, news releases, and data releases. They are valuable tools that help traders stay informed about significant events and plan their trading strategies accordingly.

How to Use Economic Calendars for Forex Trading

Traders use economic calendars to identify potential market-moving events and their scheduled release dates. By knowing when important economic data or news will be released, traders can adjust their positions or decide to stay on the sidelines during periods of heightened volatility. Economic calendars also provide additional information, such as previous data releases, market expectations, and the historical impact of specific events.

Key Factors to Consider When Evaluating Economic Calendars

When evaluating economic calendars, several factors come into play. Firstly, it’s crucial to consider the importance of an event. Major economic indicators or central bank announcements tend to have a more significant impact on the market compared to less influential reports. Traders should prioritize events that have a history of influencing currency values.

- Market Expectations: Market expectations also play a role. If the market already anticipates a specific outcome, the currency’s reaction to the actual result may be muted. Traders need to consider these expectations and assess how potential surprises could affect market sentiment.

- Historical Impact: Studying historical data can provide insights into how specific events have influenced currency values in the past. By analyzing the historical impact of events, traders can gain a better understanding of potential market reactions and adjust their strategies accordingly.

Frequently Asked Questions

7 Secret Key Concepts: An Introduction to Forex Trading for Beginners

Q: What is fundamental analysis in Forex trading?

A: Fundamental analysis is a method of evaluating the intrinsic value of a currency by examining economic, financial, and geopolitical factors. It involves studying economic indicators, central bank decisions, news releases, and other relevant data to understand the underlying forces that drive currency price movements.

Q: How do economic indicators impact currency values?

A: Economic indicators provide insights into a country’s economic health and performance. Positive indicators, such as strong GDP growth or low unemployment rates, can increase currency demand and strengthen its value. Conversely, negative indicators can weaken a currency. Traders closely monitor economic indicators to anticipate potential currency movements and make informed trading decisions.

Q: What role do news releases play in Forex trading?

A: News releases, including economic data, central bank announcements, and geopolitical events, can significantly influence market sentiment and currency values. Traders monitor news releases to identify trading opportunities and manage risks. The impact of news releases can lead to short-term market volatility, and traders adjust their strategies accordingly to capitalize on potential price movements.

Q: How can economic calendars be used for Forex trading?

A: Economic calendars provide a schedule of upcoming economic events and data releases. Traders use them to stay informed about significant events and plan their trading strategies accordingly. By knowing when important economic data or news will be released, traders can adjust their positions or decide to stay on the sidelines during periods of heightened volatility.

Q: How do interest rates and central bank decisions affect currency values?

A: Interest rates set by central banks can influence currency values. Higher interest rates attract foreign investors seeking higher returns, which can strengthen the currency. Conversely, lower interest rates may make a currency less attractive, potentially leading to currency depreciation. Central bank decisions, including interest rate changes and monetary policy decisions, can have a significant impact on currency values and are closely monitored by Forex traders.

Q: What is the significance of the trade balance and current account in Forex trading?

A: The trade balance measures the difference between a country’s exports and imports, while the current account includes additional financial flows. A positive trade balance or current account surplus can indicate economic strength and competitiveness, potentially leading to currency appreciation. Conversely, a negative trade balance or current account deficit may raise concerns about economic weaknesses, potentially resulting in currency depreciation. Forex traders pay attention to these indicators as they can impact currency values.

Conclusion of Forex Fundamental Analysis

Mastering fundamental analysis is essential for successful Forex trading. By understanding economic indicators, analyzing news releases, and utilizing economic calendars, traders can gain valuable insights into market dynamics and make more informed trading decisions. Continuous learning and practice are key to becoming proficient in fundamental analysis and achieving trading success in the Forex market.

Remember, successful Forex trading requires a combination of knowledge, experience, discipline, and adaptability. Embrace the journey of learning and refining your trading strategies, and always manage your risks wisely. With dedication and persistence, you can navigate the Forex market with confidence and improve your chances of achieving consistent profitability.

Happy trading! Download the most useful Forex Indicators

We value your thoughts and opinions! As a reader of our blog post on fundamental analysis in Forex trading, we invite you to share your insights and experiences in the comments section below. Whether you have questions, additional examples to share, or personal anecdotes related to the topic, we would love to hear from you. Your comments not only contribute to the ongoing conversation but also provide an opportunity for us to learn from each other and deepen our understanding of Forex trading. So, don’t hesitate to join the discussion and leave a comment. We look forward to engaging with you!