[What is spread in Forex trading?] Forex trading can be an exciting and potentially profitable venture. However, it’s important to understand various concepts associated with it. One such concept is the Forex Trading spread. In this blog post, we will explore what spread means in Forex trading and why it’s crucial to grasp its significance.

“If you prefer the audio version of this blog article, please follow this Youtube link.“

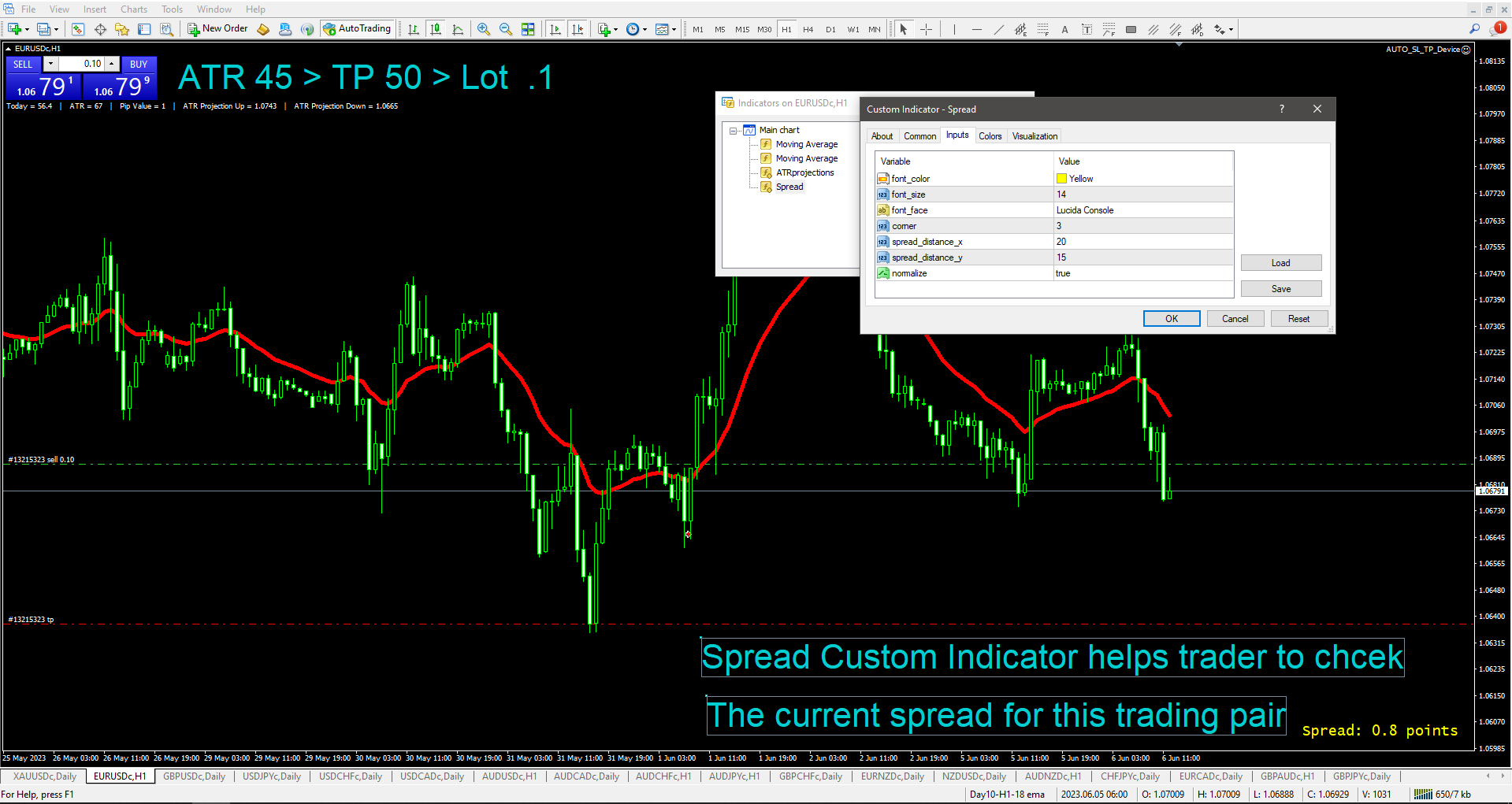

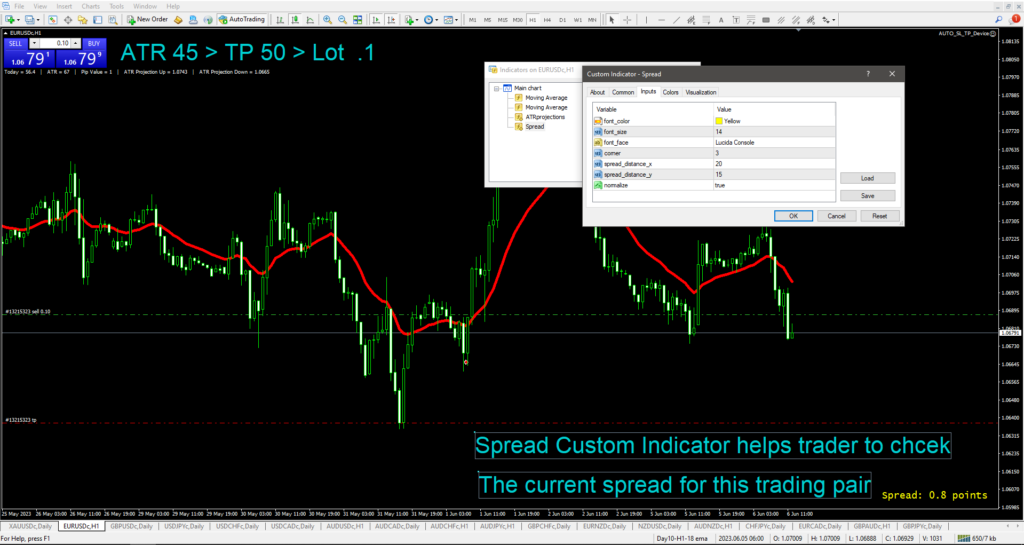

At the very beginning of the post, you saw the feature image with the custom Spread indicator. This indicator helps very much when I enter the trade or even exit. This indicator helps me to save unnecessary pips expenses. like, when the market is too volatile, the spread is much wider than usual and I can see it quickly to look at the current spread. you must remember the spread comes from your pocket either you profit or loss that particular trade. Before choosing the Forex broker three things you need to remember, reputable with license, instant withdrawal, and minimal spread.

What is Spread in Forex Trading?

Spread refers to the difference between the bid price and the asking price of a currency pair. The bid price is the price at which you can sell the base currency, while the asking price is the price at which you can buy the base currency. For instance, let’s say the bid price for EUR/USD is 1.2400, and the asking price is 1.2402. The spread in this case would be 0.0002 or 2 pips.

Why Spread Matters in Forex Trading

Understanding the role of spread is essential because it directly impacts your trading costs. When you enter a trade, you start with a small negative balance due to the spread. For example, if the spread is 2 pips and you buy a currency pair, the trade will only become profitable once the market moves in your favor by at least 2 pips.

Spread also plays a significant role in determining the liquidity of a currency pair. Highly liquid pairs tend to have smaller spreads, while less liquid pairs have wider spreads. This is because lower liquidity makes it more challenging to find buyers or sellers at desired prices, leading to wider spreads.

To illustrate this, let’s consider the EUR/USD currency pair, which is one of the most actively traded pairs. Due to its high liquidity, the spread for EUR/USD is often relatively low, making it an attractive choice for many traders.

What are the potential benefits of Forex trading?

Different Types of Spreads

In Forex trading, there are two main types of spreads: fixed spreads and variable spreads.

- Fixed spreads remain constant regardless of market conditions. This means that the difference between the bid and ask price remains the same, regardless of the level of volatility or liquidity. Fixed spreads can provide predictability and stability in trading, especially during times of high market volatility.

- Variable spreads, on the other hand, fluctuate based on market conditions. During periods of high volatility or low liquidity, variable spreads tend to widen. Conversely, when market conditions are stable, variable spreads can be narrower. Traders should be aware that variable spreads can increase trading costs, especially during turbulent market periods.

What are the risks involved in Forex trading?

Factors Affecting Spread Size

Several factors influence the size of spreads in Forex trading. Understanding these factors can help traders anticipate potential changes in spreads. The key factors include:

- Market Volatility: Spreads tend to widen during times of increased volatility. This is because volatile markets present higher risks and can lead to wider price fluctuations, resulting in wider spreads.

- Liquidity: Higher liquidity generally corresponds to narrower spreads. Liquid markets have a higher number of buyers and sellers, making it easier to execute trades at competitive prices and reducing the spread.

- Trading Session: Spreads can vary based on the trading session. For instance, during the overlap of major trading sessions, such as when both the London and New York sessions are open, spreads may be tighter due to increased trading activity.

How to Interpret Spread in Forex Trading

Understanding how to interpret spreads can provide valuable insights into market conditions. Traders can analyze spreads in the following ways:

- Spread as an Indicator: Widening spreads may indicate increased market uncertainty or impending news releases. Conversely, narrowing spreads can signal market stability or consolidation.

- Spread Comparison: Comparing spreads across different currency pairs can help traders identify the most cost-effective options. By analyzing historical data, you can determine which currency pairs consistently offer tighter spreads, allowing for potentially lower trading costs.

How long time will it take to learn basic to intermediate Forex Trading?

Tips for Managing Spread in Forex Trading

Managing spreads effectively can contribute to a trader’s overall profitability. Here are some tips to consider:

- Choosing a Broker: Select a broker that offers competitive spreads. Compare spreads from different brokers to ensure you are getting the best value for your trades.

- Timing Trades: Monitor market volatility and aim to execute trades during periods of lower volatility when spreads are typically tighter.

- Utilizing Limit and Stop Orders: Use limit orders to enter trades at desired prices and stop orders to protect against excessive spread widening during market volatility.

Frequently Asked Questions about Forex Trading Spread

Q1: How does spread impact my trading costs?

- A1: Spread directly affects your trading costs. It represents the initial negative balance you start with when entering a trade. For example, if the spread is 2 pips and you buy a currency pair, the trade will only become profitable once the market moves in your favor by at least 2 pips. Therefore, wider spreads can increase your breakeven point and make it more challenging to generate profits.

Q2: What is the difference between fixed and variable spreads?

- A2: Fixed spreads remain constant regardless of market conditions, providing stability and predictability in trading. On the other hand, variable spreads fluctuate based on market conditions. During periods of high volatility or low liquidity, variable spreads tend to widen. Traders should be aware that variable spreads can increase trading costs, especially during turbulent market periods.

Q3: How can I find a broker with competitive spreads?

- A3: When looking for a broker with competitive spreads, compare offerings from different brokers. Consider factors like the average spreads they provide, the range of currency pairs available, and any additional fees or commissions involved. Additionally, read reviews and consider the broker’s reputation, reliability, and customer support. A reputable broker will offer competitive spreads and transparent pricing.

Q4: Does spread size vary for different currency pairs?

- A4: Yes, spread size can vary across different currency pairs. Highly traded and liquid pairs, such as EUR/USD, tend to have tighter spreads due to high market liquidity. Less frequently traded pairs or those with lower liquidity may have wider spreads. It’s important to consider the spread for specific currency pairs you wish to trade, as it directly impacts your trading costs and potential profitability.

Q5: Can I trade Forex without paying spreads?

- A5: While it’s not possible to completely avoid spreads in Forex trading, some brokers offer alternative fee structures, such as commission-based spreads. With commission-based spreads, traders pay a fixed commission per trade instead of wider spreads. This can be beneficial for high-frequency traders or those who prefer transparency in their trading costs. However, it’s important to compare and calculate the overall costs to determine which fee structure is more cost-effective for your trading style.

How much capital do I need to start Forex trading?

Conclusion of Forex Trading Spread

Understanding the concept of spread is crucial for Forex traders. It affects trading costs, liquidity, and overall profitability. By grasping the significance of spreads, analyzing market conditions, and implementing effective strategies, traders can make informed decisions and optimize their trading results. Remember to choose a reliable broker, consider timing your trades strategically, and utilize limit and stop orders to manage spreads effectively. Happy trading!

If you’re interested in the custom indicator Spread follow the google drive link to download

[lockercat] Download Spread custom indicator [/lockercat]

How to Use Forex Custom Indicators, Templates, and Profiles in MT4?

[table id=2 /]We value your thoughts and opinions! We encourage you to share your insights and experiences by leaving a comment below. Whether you have questions, feedback, or additional information to contribute, your input is highly appreciated. Your comments not only help us create a vibrant community but also provide valuable perspectives for other readers. So, don’t hesitate to join the conversation and let your voice be heard. We look forward to hearing from you!