Forex trading can be a profitable venture, but it requires a sound understanding of various technical indicators to make informed decisions. One such popular tool is Bollinger Bands, a versatile indicator that helps traders identify trends, gauge market volatility, and find potential entry and exit points. In this article, we’ll dive into the world of Bollinger Bands and provide you with ten effective tips to master Forex trading with Bollinger Bands.

What are Bollinger Bands?

Which Forex broker is reliable for Forex trading and has less spread and instant withdrawal?

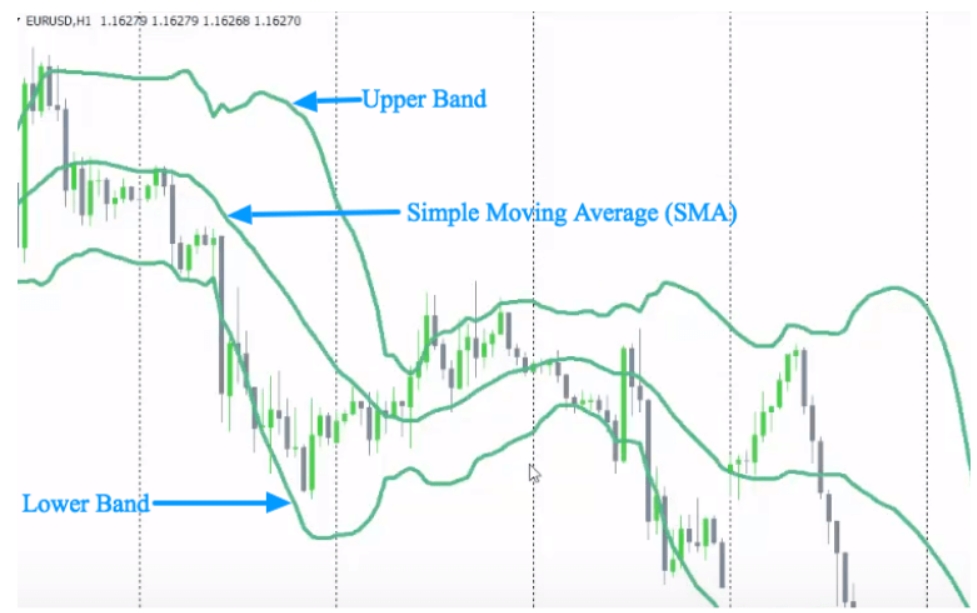

Bollinger Bands consist of three lines: the middle band, an upper band, and a lower band. The middle band is a simple moving average (SMA) that represents the average price over a specific period. The upper and lower bands are standard deviations away from the middle band. The distance between the bands expands and contracts based on market volatility, providing valuable insights into price action.

How Bollinger Bands Work

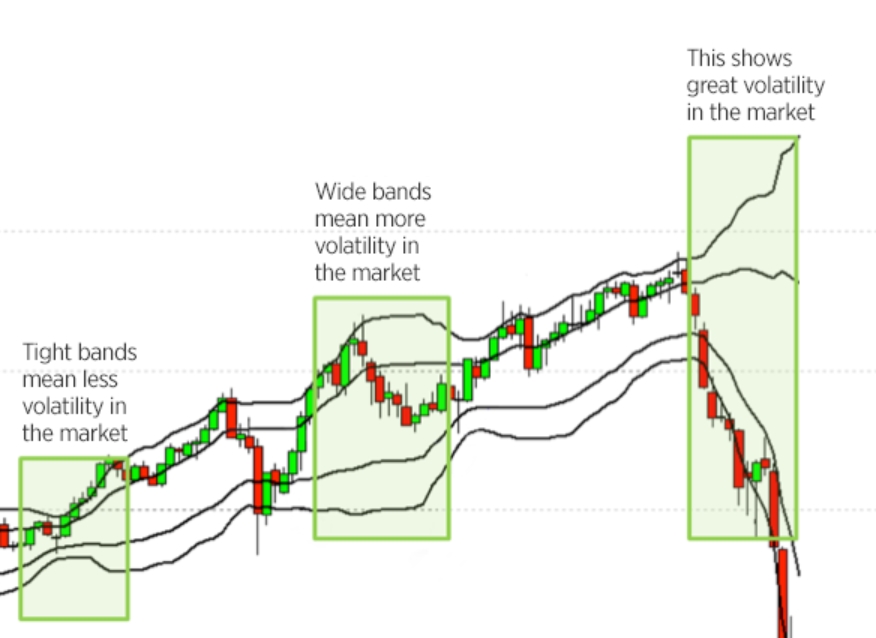

The dynamic nature of Bollinger Bands allows traders to identify periods of high and low volatility. During high volatility, the bands widen, indicating potential market tops and bottoms. Conversely, in low volatility situations, the band’s contract, suggests a potential price breakout.

Importance in Forex Trading Bollinger

What is the Forex market and how it’s work?

Bands are widely used by Forex traders due to their ability to capture significant market movements. They help identify optimal entry and exit points and provide a comprehensive picture of price action, aiding traders in making well-informed decisions.

Interpreting Bollinger Bands

To use Bollinger Bands effectively, it’s crucial to understand their components and interpret the signals they provide.

Identifying the Middle Band, Upper Band, and Lower Band Let’s consider an example of the EUR/USD currency pair with a 20-period SMA as the middle band and two standard deviations (SD) above and below the SMA to construct the upper and lower bands. If the 20-period SMA is at $1.1500, the upper band would be at $1.1600, and the lower band at $1.1400.

Recognizing Volatility and Price Action Signals

What is fundamental analysis in Forex trading?

When the price moves near the upper band, it signals overbought conditions, and a reversal may be imminent. On the other hand, when the price nears the lower band, it indicates oversold conditions and a potential bullish reversal. Moreover, when the bands contract, it suggests that a breakout is on the horizon.

Tip 1: Setting up Bollinger Bands for Forex Trading Selecting the Right Timeframe The choice of timeframe depends on your trading style. For short-term traders, lower timeframes like 5-minute or 15-minute charts are suitable, while swing traders may prefer hourly or daily charts.

Choosing the Appropriate Period and Standard Deviation The number of periods used in calculating the SMA and the standard deviation affects the sensitivity of the bands. Experiment with different periods and SD values to find the settings that align with your trading strategy.

Tip 2: Combining Bollinger Bands with Other Indicators To increase the accuracy of your trades, consider combining Bollinger Bands with other indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI). For instance, if the RSI confirms an overbought condition near the upper band, it strengthens the signal for a potential reversal.

Tip 3: Using Bollinger Bands to Identify Trends Bollinger Bands can help identify the strength and direction of trends. When prices are consistently trading near the upper band, it indicates a strong uptrend, and vice versa for a downtrend. When the bands expand, it signals a robust trend, while contraction suggests a potential trend reversal.

Tip 4: Bollinger Squeeze Strategy The Bollinger Squeeze pattern occurs when the bands contract significantly, indicating low volatility. Traders anticipate a price breakout and use this setup to position themselves for potential high-impact moves.

Tip 5: Setting Stop Loss and Take Profit Levels Bollinger Bands can help determine appropriate stop-loss levels by placing them just outside the bands. For take-profit targets, consider previous price levels or the opposite band.

What are Support Resistance and Chart types in Forex trading?

Tip 6: Managing Risk with Bollinger Bands Volatility can impact your trade’s risk, so adjust your position size accordingly. For higher volatility, reduce your position size to manage risk effectively.

Tip 7: Avoiding Common Mistakes in Bollinger Bands Trading Avoid overtrading based solely on Bollinger Bands signals. Consider combining multiple indicators and performing a comprehensive analysis.

Tip 8: Backtesting and Optimizing Bollinger Bands Strategy Before applying your strategy in real-time, backtest it on historical data to assess its performance. Tweak your approach as needed to maximize profitability.

Tip 9: Keeping a Trading Journal Maintain a trading journal to record your Bollinger Bands trades and observations. Regularly review your journal to learn from past successes and mistakes.

Tip 10: Staying Disciplined and Patient Discipline and patience are essential in Forex trading. Stick to your strategy and wait for the right Bollinger Bands setups to avoid impulsive decisions.

Frequently Asked Questions

How to Identify Support and Resistance Levels in Technical Analysis?

Q1: What are Bollinger Bands in Forex trading?

- Bollinger Bands are technical indicators that consist of three lines: the middle band, an upper band, and a lower band. They help traders analyze market volatility and identify potential entry and exit points. The middle band is a simple moving average (SMA), while the upper and lower bands represent standard deviations from the SMA.

Q2: How do I use Bollinger Bands to spot trend reversals?

- To identify trend reversals using Bollinger Bands, observe the price action near the bands. When the price touches or penetrates the upper band, it could indicate an overbought condition and signal a potential bearish reversal. Conversely, when the price touches or penetrates the lower band, it might signify an oversold condition and suggest a potential bullish reversal.

Q3: Can I combine Bollinger Bands with other indicators for better results?

- Yes, combining Bollinger Bands with other indicators can enhance your trading strategy’s accuracy. Popular choices include the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI). For instance, if the RSI confirms overbought or oversold conditions near the bands, it strengthens the Bollinger Bands’ signals.

Q4: How can I use the Bollinger Squeeze strategy effectively?

- The Bollinger Squeeze strategy works best in low-volatility situations. When the bands contract significantly, it signals a potential breakout. Traders can position themselves for high-impact moves by entering long positions above the upper band’s breakout or short positions below the lower band’s breakout.

Q5: What role do Bollinger Bands play in risk management?

- Bollinger Bands can aid in setting stop-loss levels. Placing the stop-loss just outside the bands can protect your trades from excessive losses. Additionally, you can adjust your position size based on the market’s volatility, ensuring you manage risk effectively during different market conditions.

Conclusion

Bollinger Bands are a powerful tool in Forex trading, providing valuable insights into market trends and volatility. By understanding and effectively using Bollinger Bands, traders can make more informed decisions and increase their chances of success in the dynamic world of Forex trading. Remember to combine Bollinger Bands with other indicators, manage risk, and maintain discipline throughout your trading journey. Happy trading!

Do you need a Deep Road Map for Forex learning? Structural Forex Trading Learning Road Map

We hope you found our article on “10 Effective Tips for Mastering Forex Trading with Bollinger Bands” informative and insightful. Now, we’d love to hear from you! Whether you’re an experienced Forex trader or just starting your thoughts, experiences, and questions are valuable to the entire community and us. We encourage you to share your comments and engage in meaningful discussions with fellow readers. Together, let’s foster a supportive environment to enhance our Forex trading skills and achieve greater success. We’re excited to hear from you!